ny paid family leave taxable

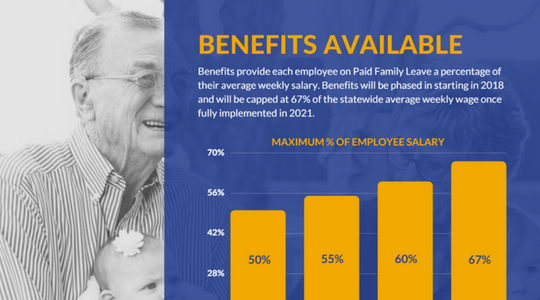

In 2021 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage of 145017. Pursuant to the Department of Tax Notice No.

Paid Family Leave Community Service Society Of New York

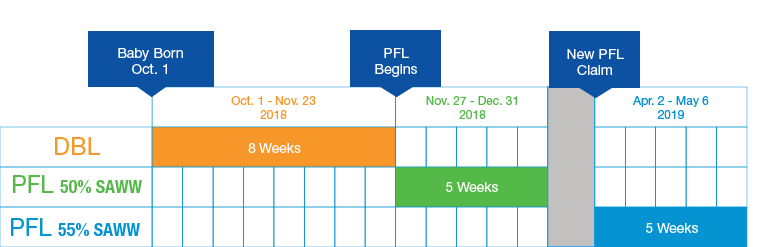

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or.

. Employers do not withhold taxes on an employees PFL benefits because they are not included in payroll. 2022 Paid Family Leave Payroll Deduction Calculator. Paid Family Leave provides eligible employees job-protected paid time off to.

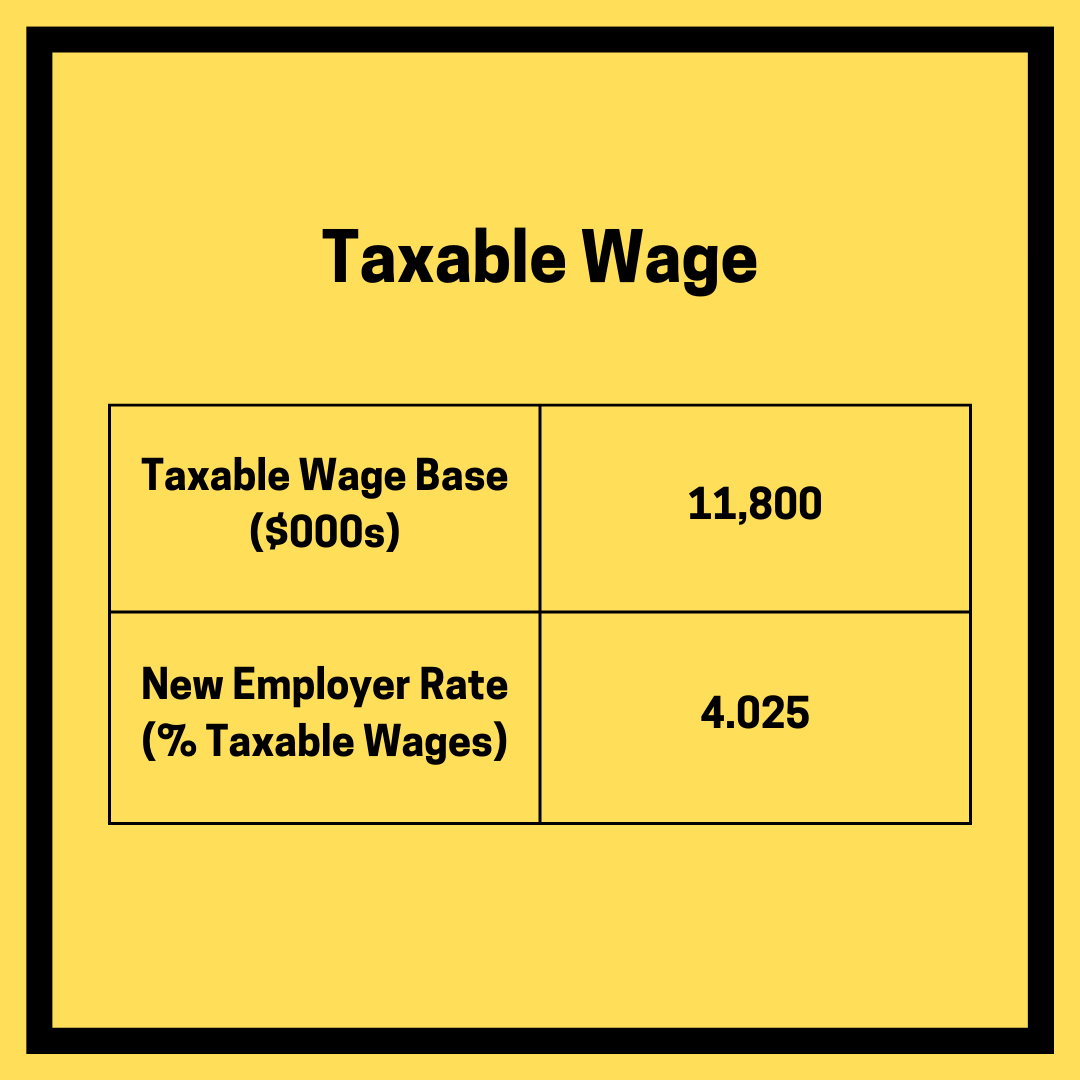

What Is Ny Paid Family Leave Tax. The maximum annual contribution is 42371. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross.

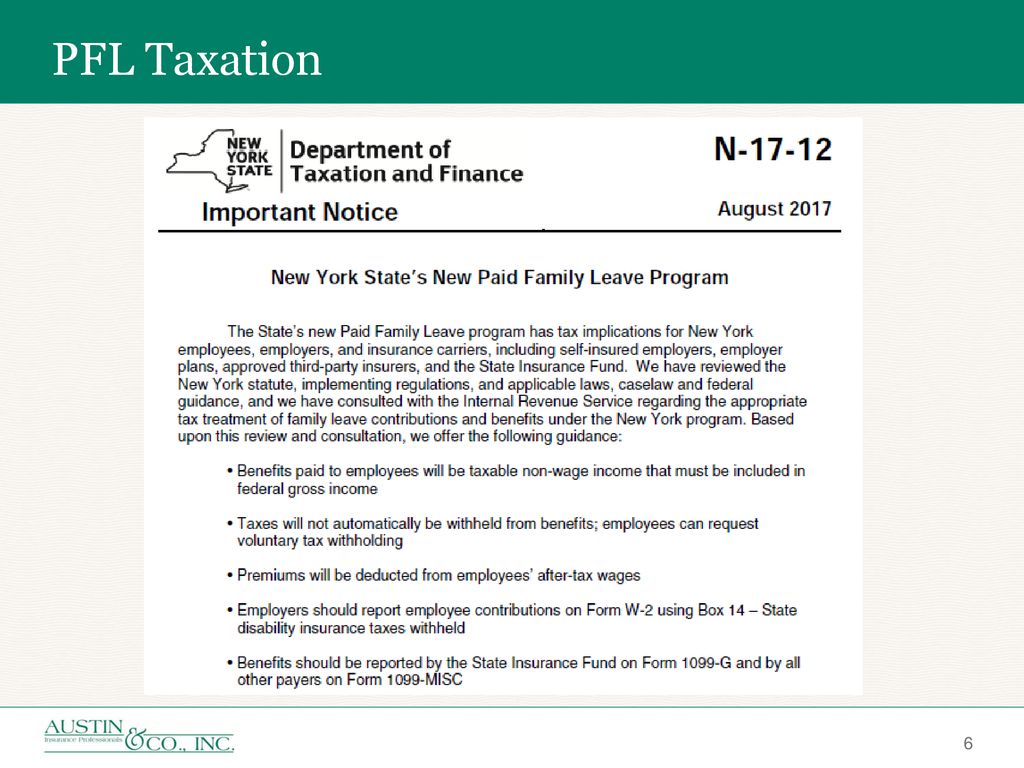

The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. New York States Department of Taxation and Finance released guidance regarding the tax implications of New York Paid Family Leave PFL the benefits of. NYSIF is a not-for-profit agency of the State of New York that offers workers compensation New York State disability benefits and Paid Family Leave insurance.

Now after further review the New York Department of Taxation and. In New Jersey go to Other Non-Wage IncomeYou will see a Description and Amount from your employers 1099-MISC. No deductions for PFL are taken from a businesses tax contributions.

The maximum weekly benefit for 2021 is 97161. The contribution remains at just over half of one percent of an employees gross. The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a.

Pursuant to the Department of Tax Notice No. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. Solution found The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will.

At 67 of pay up to a cap Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current New York State Average Weekly Wage. In 2022 the employee contribution is 0511 of an employees gross wages each pay period. They are however reportable as.

State governments do not automatically withhold paid family leave. Employers may collect the cost of Paid Family Leave through payroll deductions. Aug 31 2017.

Yes NY PFL benefits are considered taxable non-wage income subject. New York paid family leave benefits are taxable contributions must be made on after-tax basis. Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New. Enter another line Non-taxable NY Paid Family. The Paid Family Leave wage replacement benefit is also increasing.

After discussions with the Internal Revenue Service and its review of other legal. New York designed Paid Family Leave to be easy for employers to implement with three key tasks. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions.

Your insurance carrier may provide options for how you will be paid for example via direct deposit debit card or paper check. 2 Collect employee contributions to pay for their. 1 Obtain Paid Family Leave coverage.

It is a separate and distinct.

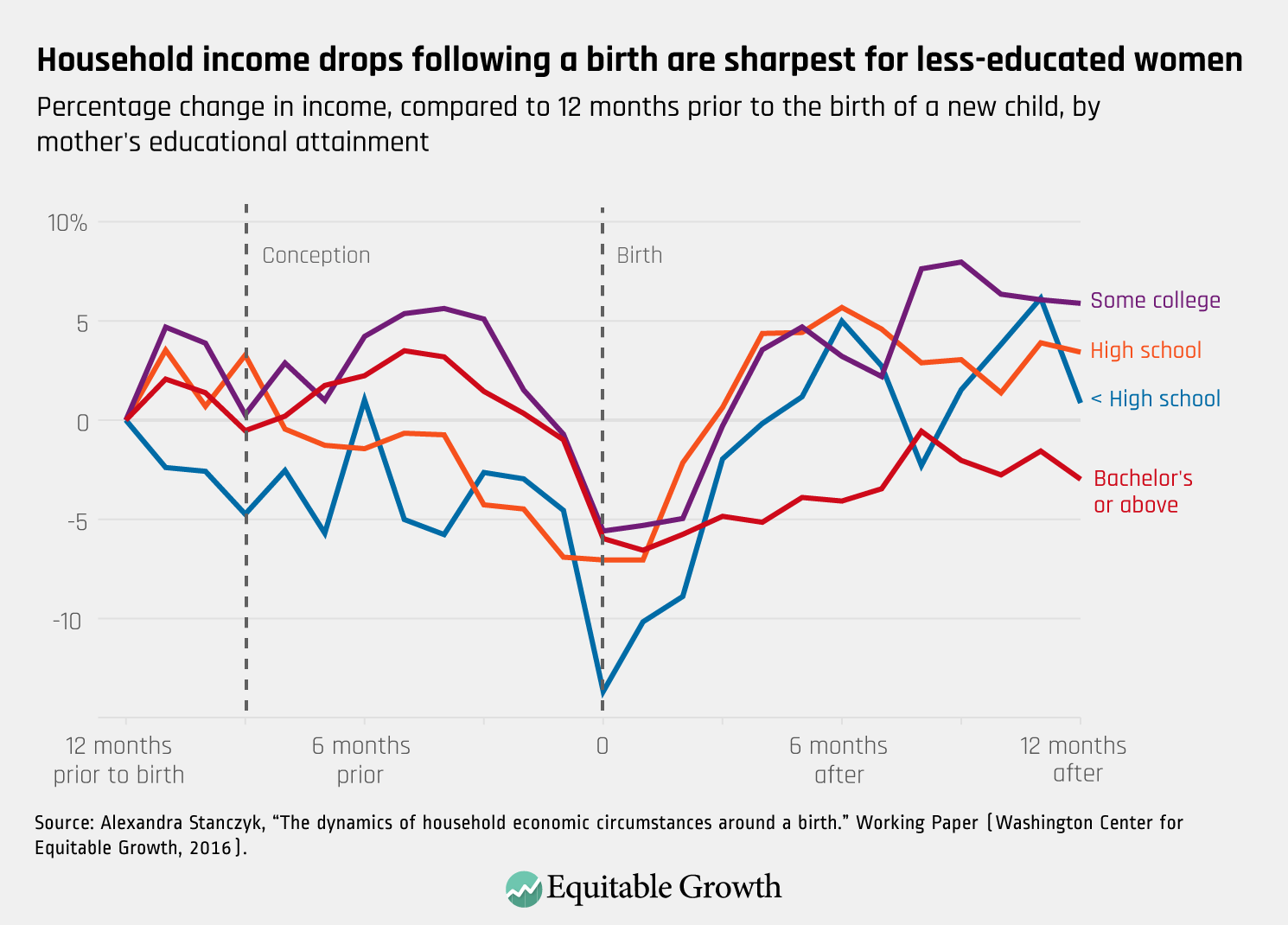

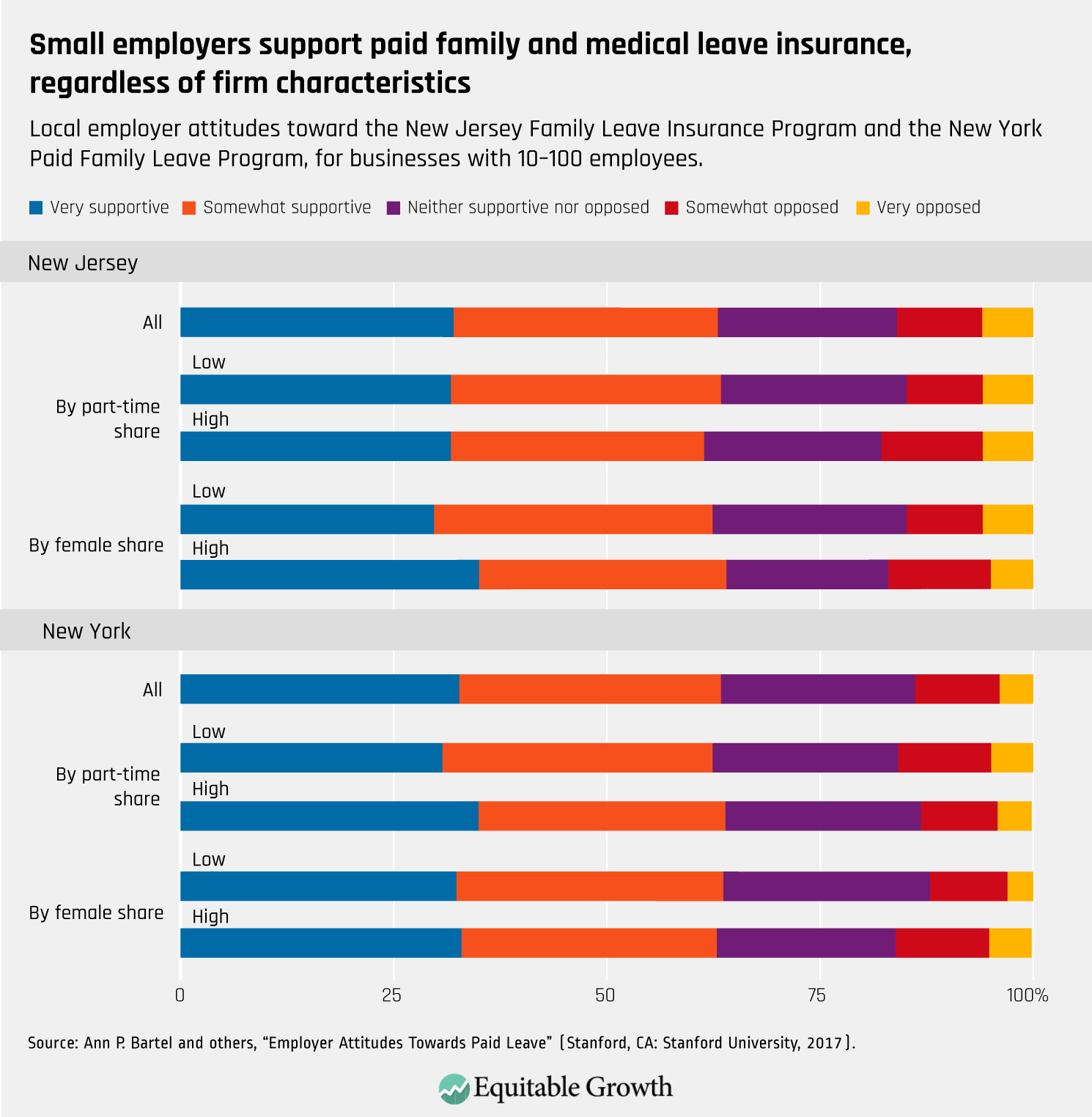

Paid Family And Medical Leave In The United States A Research Agenda Equitable Growth

Ny Paid Family Leave Benefits Shelterpoint

7 Things To Know About New York S Paid Family Leave Law Employee Benefit News

Paid Family Leave Community Service Society Of New York

Nys Paid Family Leave Nypfl Aa Tc Inc

Bonding Leave For The Birth Of A Child Paid Family Leave

Ny Paid Family Leave Rate For 2023 Shelterpoint

Nys Paid Family Leave Overview What We Know Today Ppt Download

Explainer Paid Leave Benefits And Funding In The United States

New York Paid Family Leave Taxable Income

Paid Family And Medical Leave In The United States A Research Agenda Equitable Growth

Pregnancy And Maternity Paternity Leave In Ny State The Law Offices

Is New York Paid Family Leave Taxable

Free Pdf Guide Understanding New York Paid Family Leave

2021 State Paid Family And Medical Leave Contributions And Benefits Mercer

Ny Paid Family Leave 5 Key Changes For 2019 The Standard

A Complete Guide To New York Payroll Taxes

Your Total Rewards Cornell University Division Of Human Resources